Figure payroll taxes

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Web How Your Paycheck Works.

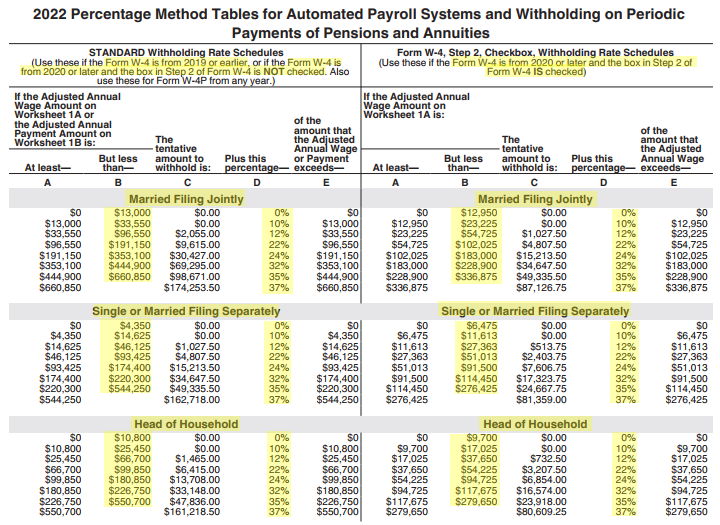

How To Calculate Payroll Taxes Methods Examples More

Federal income taxes are levied on an.

. Ad Based On Circumstances You May Already Qualify For Tax Relief. Free Unbiased Reviews Top Picks. Web FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

As stated earlier income taxes are different from payroll taxes but are taken out of an employees paycheck. Web The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Web Components of Payroll Tax.

Well Do The Work For You. Gross taxable wages include the cumulative salaries. Web Federal income taxes.

Web Calculate payroll taxes. Web Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Payroll FICA and FUTA taxes are calculated from an employees gross taxable wages.

The state tax year is also 12 months but it differs from state to state. Taxes Paid Filed - 100 Guarantee. Ad Compare This Years Top 5 Free Payroll Software.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Web Step 1. Get Started With ADP Payroll. The standard FUTA tax rate is 6 so.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Sign up make payroll a breeze.

Ad Simply the best payroll app for small business. It can be tough to figure. This component of the Payroll tax is withheld and forms a revenue source for the Federal.

For example if an. Do You Own a Business w 5 or More W-2s. Ad Process Payroll Faster Easier With ADP Payroll.

Owners Can Receive Up to 26000 Per Employee. The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be. See If Your Business Qualifies For the Employee Retention Tax Credit.

Get Started With ADP Payroll. Some states follow the. Ad Process Payroll Faster Easier With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Web For example if an employee makes 40000 annually and is paid biweekly divide their annual wages 40000 by 26 to get their total gross pay for the period. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations.

Web 2020 Federal income tax withholding calculation. It comprises the following components. Household Payroll And Nanny Taxes Done Easy.

Web How to calculate annual income. The calculator includes options for estimating Federal Social. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate Net Pay Step By Step Example

How To Calculate Federal Income Tax

How To Calculate Federal Income Tax

Payroll Taxes How Much Do Employers Take Out Adp

How To Calculate Federal Income Tax

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Payroll Taxes Methods Examples More

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Calculate Taxes On Paycheck Highest Discount 57 Off Lamphitrite Palace Com

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Powerchurch Software Church Management Software For Today S Growing Churches

Federal Income Tax Fit Payroll Tax Calculation Youtube